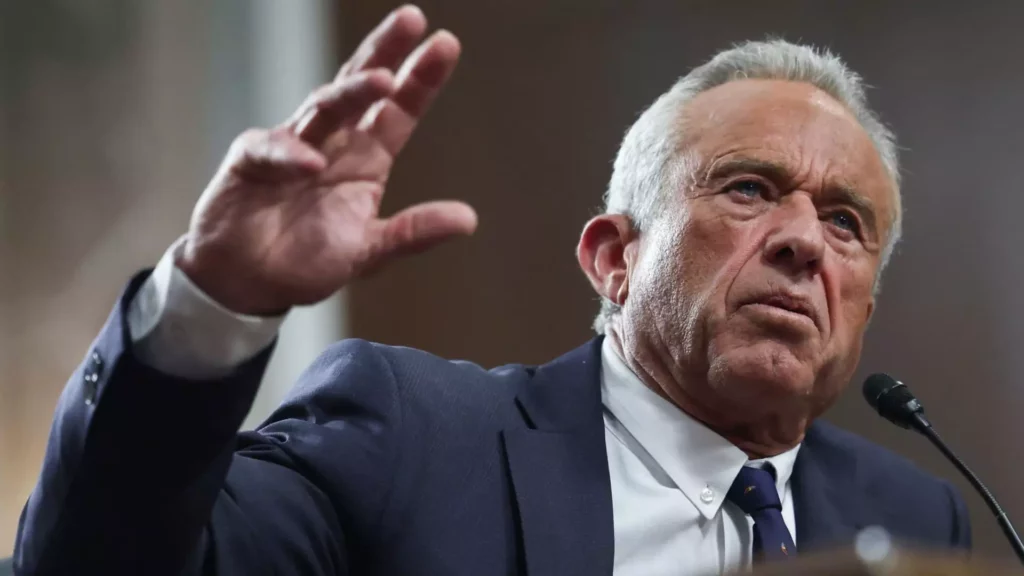

The recent revelation that Americans’ credit card balances have surged to an eye-watering $1.17 trillion in 2024 illustrates a troubling financial trend that transcends income brackets and personal wealth. It’s an unsettling fact that even prominent figures—like Robert F. Kennedy, Jr., who carries a staggering credit card debt ranging between $610,000 to $1.2 million—are caught in this financial bind. His predicament serves as a stark warning about the fragility of financial health in a landscape marred by rising costs and insatiable inflation.

Kennedy’s situation becomes even more perplexing when considering his approximate $30 million net worth. According to financial analysts, the interest rates on his credit cards hover between 23.24% and 23.49%, rates that would make any individual shudder. It provokes the question: how does an individual with such significant income find himself ensnared in such a web of debt? This conundrum shines a light on the broader issue facing many high-income earners today.

The False Sense of Security

What is truly disconcerting is that many people, particularly those in higher income brackets, appear to have a distorted perception of credit card usage. While they often use credit cards for their perceived benefits—such as accumulating rewards or enjoying exclusive services—they lure individuals into cycles of debt that can be disastrous. Reports reveal that a staggering 59% of borrowers earning over $100,000 have been in credit card debt for at least a year, with 24% of them in debt for over five years. Such statistics should alarm us all; they reveal a troubling trend where high incomes do not equate to sound financial practices.

Experts argue that many wealthy individuals are blinded by the allure of credit card perks and higher credit limits. Rather than practicing responsible borrowing, they often succumb to the illusion of financial security offered by easily accessible credit. This psychological barrier makes them susceptible to making reckless financial decisions that can have long-term repercussions on their financial landscapes.

Many financially literate individuals are aware of the prudent approach to managing debt—prioritizing paydowns to avoid crippling interest costs. However, the striking reality that Americans increasingly see credit cards as de facto emergency funds reflects a deeper societal issue. As inflation rises and wages stagnate, many are capturing their financial situations through the burgeoning debt offered by credit cards. Financial analyst Matt Schulz remarked that inflation has squeezed many families’ budgets to the point where credit card usage has become a survival mechanism.

Kennedy’s case, while extreme, encapsulates the broader societal trend. If he were to contribute $50,000 monthly toward his lower estimated balance of $610,000, it could take up to 15 months to settle the debt, costing him an additional $93,000 in interest alone. This scenario illustrates just how punishing high interest rates can be, both for high earners and average households alike. The average credit card borrower already faces about $6,380 in debt as of Q3 2024, a significant burden that further strains household finances.

The erroneous belief that high-income individuals are sheltered from the pitfalls of bad financial management is dangerous. The rise of unsecured debt illustrates that money alone does not confer wisdom when it comes to fiscal responsibility. Financial planners argue that the more affluent one becomes, the greater the temptation to accumulate debt for various privileges. Credit cards, despite their perks, tend to be less effective compared to alternative forms of borrowing, particularly for wealthier individuals who often maintain established lines of credit for substantial purchases.

Financial professionals warn against allowing credit card debt to proliferate unchecked. Charlie Douglas, a certified financial planner, advocates for a proactive approach: maintaining liquidity equivalent to a year’s worth of expenses as a buffer against financial strain. His guidance resonates, particularly in a financial climate where the intersection of credit card debt and a poor economic environment is becoming more commonplace.

As credit card debt continues to escalate, with higher-income individuals leading the charge, it’s essential to cultivate an awareness of responsible financial practices. It’s easy to become ensnared by the superficial benefits of credit, especially in a consumer-driven society where instant gratification reigns supreme. Yet, the true wealth of any individual lies not in the accumulation of credit card points or lavish experiences, but in solid fiscal foundations established through prudent debt management.

The staggering statistic of $1.17 trillion in credit card balances is not merely a reflection of irresponsible spending but a wake-up call for American society. This astronomical amount represents not only a financial crisis but a clarion call for individuals—wealthy or otherwise—to reevaluate their financial habits and prioritize debt reduction above all else.