In recent years, China’s booming real estate industry has faced significant turmoil, as a combination of high debt levels and regulatory crackdowns left many construction projects unfinished and homebuyers disillusioned. Consequently, the government has taken a series of aggressive steps to revitalize this crucial sector, which once contributed more than 25% to the nation’s economy. A notable recent announcement involves an ambitious expansion of the government’s “whitelist” initiative aimed at facilitating smoother development processes for unfinished real estate projects.

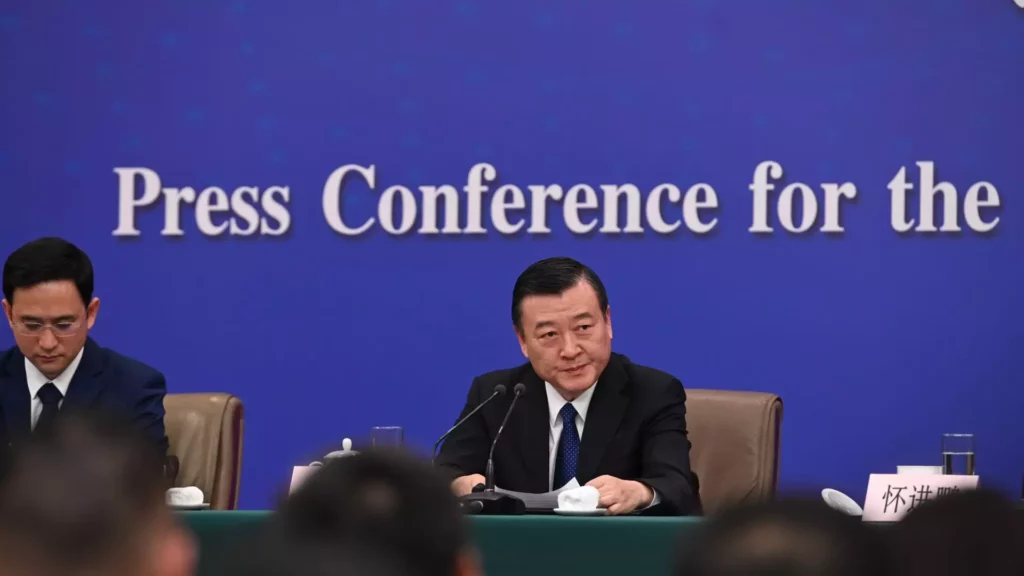

Initially introduced in January, the whitelist initiative permits city governments to designate certain residential projects as eligible for expedited bank loans. This initiative is part of a broader strategy to mend the damage inflicted by the real estate crisis, ensuring that projects can be completed and new homes delivered to buyers without further delays. According to Ni Hong, China’s Minister of Housing and Urban-Rural Development, the limit on bank loans earmarked for these developers will surge from the already substantial 2.23 trillion yuan to 4 trillion yuan (approximately $561.8 billion) by the end of the current year. This increase is critical to accelerating the completion of developments that have been stalled due to financial constraints.

Financial Measures to Encourage Stability

Supporting the whitelist initiative are additional financial strategies designed to rejuvenate the real estate market. The People’s Bank of China has already reduced the reserve requirement ratio, encouraging banks to lend more capital. Furthermore, a significant change to the minimum down payment percentage for second-home loans will allow more buyers to enter the market, potentially increasing property sales and investor confidence. These steps indicate a concerted effort by financial regulators and the government to bolster the market amid widespread concerns regarding declining sales and prices.

Despite these robust measures, investor sentiment remains tepid. Following the announcement of new policies, the CSI 300 real estate index experienced a sharp decline, illustrating a lack of belief in the efficacy of the measures proposed. Analysts have suggested that while the government’s efforts represent progress, there is still a considerable gap between policy implementation and real market recovery. Chi Lo from BNP Paribas Asset Management echoes this sentiment, highlighting persistent volatility in the Chinese stock market and a general shortage of conviction in the sustainability of the stimulus measures.

Local Governments Taking Action

In response to the broader economic malaise, local governments across China are stepping up efforts to stimulate their real estate sectors. More than 50 cities have unveiled policies aiming to encourage home purchases, including easing restrictions for non-local buyers and eliminating limits on home purchases altogether. Cities like Guangzhou and Beijing are leading the charge, hoping to counteract the downturn seen in housing prices—dropping at their steepest rate in nearly a decade.

Despite these revitalization efforts, significant challenges remain. The domestic housing market faces a mountain of obstacles, not least of which is the lingering apprehension from potential homebuyers who have witnessed devastating declines in property prices. Numerous real estate developers have succumbed to insolvency, leading to a climate of distrust among prospective buyers. Many are reluctant to invest in new properties given the frequency of project halts and bankruptcies, which directly impacts overall market confidence.

The statistics themselves paint a stark picture – home prices were down 6.8% month-on-month as of August, with a staggering 23.6% decrease in home sales year-to-date. Such steep declines are symptomatic of a broader decline in consumer confidence, raising the pressing need for sustained and diverse policy interventions.

China’s real estate market, long a linchpin of its robust economic framework, now confronts a complex recovery phase. While the government has launched a plethora of initiatives to stabilize the sector and stimulate demand, the path ahead remains fraught with uncertainties. The real estate sector’s revival will depend heavily on the ability of these policies to restore trust among consumers, invigorate lending practices, and ultimately signal a shift towards sustained economic growth. As the government seeks to halt the lingering market decline, the effectiveness of its strategies will be tested in the coming months. The journey to recovery will indeed be long and complicated, but the commitment shown thus far is a promising step in the right direction.