Nvidia is set to unveil its fiscal third-quarter earnings report, and market analysts eagerly await the findings. Scheduled for after the market closes on Wednesday, these figures are more than just numbers; they are a reflection of Nvidia’s trajectory in a rapidly evolving tech environment. With revenue projections at $33.16 billion and an adjusted earnings per share (EPS) of 75 cents, the company’s performance will revolve around its ability to sustain growth amidst the wavering tides of the artificial intelligence sector.

While the third-quarter results themselves remain significant, the forward-looking guidance provided by Nvidia carries even more weight. Wall Street’s anticipatory estimates suggest an EPS forecast of 82 cents and projected sales reaching $37.08 billion. This hints at Nvidia’s strategy to leverage its latest innovations in artificial intelligence, particularly with the introduction of its advanced AI chip, Blackwell. With demand from tech giants like Microsoft, Google, and Oracle, stakeholders are keen to assess whether this next-generation chip can solidify Nvidia’s market dominance.

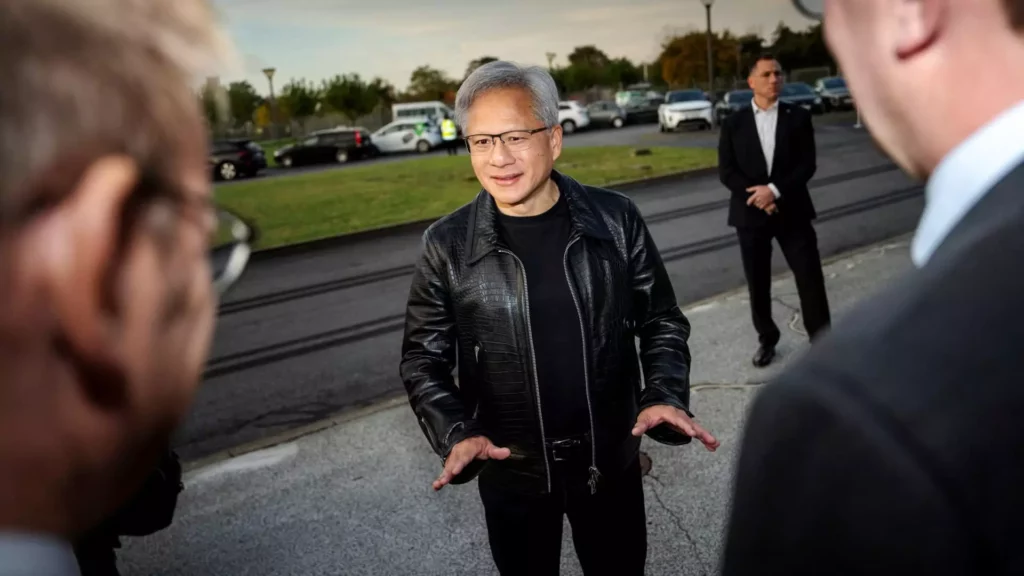

However, Nvidia is not without its challenges. Reports have surfaced regarding overheating issues experienced by some systems utilizing Blackwell chips. Such technical difficulties present risks not only to short-term sales but also to the company’s long-standing reputation for excellence in semiconductor production. Investors will scrutinize CEO Jensen Huang’s remarks on this matter, as his insights will be pivotal in shaping investor sentiment and future sales expectations.

In an environment where Nvidia’s stock price has surged nearly threefold since the beginning of 2024, it’s crucial to contextualize the company’s growth within broader industry trends. The firm recorded an impressive 122% year-over-year sales growth last quarter; however, this represents a significant deceleration when compared to the eye-popping increases of 262% and 265% in the preceding quarters. Such a decline raises questions about the sustainability of Nvidia’s growth and whether the AI segment can continue to drive revenue at previous levels.

As Nvidia prepares to share its earnings, all eyes will be on its ability to remain a pivotal player amid mounting pressures. The company has established itself as a trailblazer in the AI chip market, but the emergence of challenges like product reliability will test its mettle. Looking forward, investors will be particularly focused on hearing how Nvidia plans to mitigate these potential pitfalls while leveraging Blackwell’s capabilities for sustained growth. Moving past mere performance insights, Nvidia’s future hinges on innovation, adaptability, and addressing these emerging challenges head-on as it navigates the complexities of the tech industry.