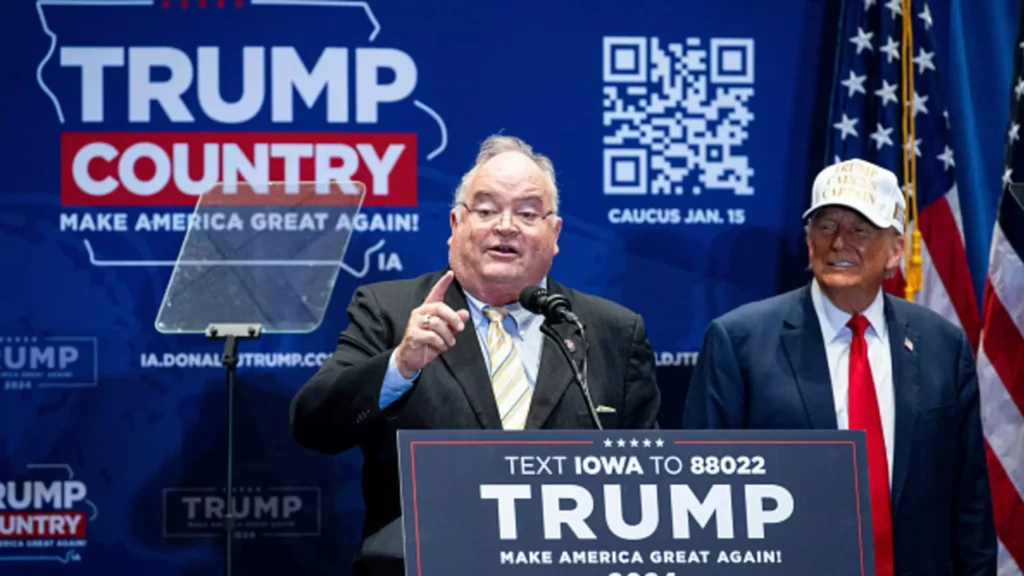

In a significant political development, President-elect Donald Trump has proposed the appointment of Billy Long, a former congressman from Missouri, to lead the Internal Revenue Service (IRS). News of this nomination has stirred a blend of excitement and apprehension across various constituencies in Washington and the tax community. Long’s potential confirmation heralds a critical pivot for the IRS, particularly as it strives to undergo a substantial overhaul designed to modernize its services and enhance compliance mechanisms among taxpayers.

Long’s selection could coincide with a broader shift in the agency’s operational priorities, particularly in light of the nearly $80 billion allocated to the IRS by Congress in 2022. This funding aims to facilitate improvements in customer service, technological infrastructure, and enforcement activities to corral unpaid taxes, especially from high earners and large corporations. However, these ambitious plans might be jeopardized if the political winds shift under Trump’s administration, as warned by several analysts. The debate revolves around the agency’s direction, accountability, and resources, as Republicans have frequently criticized these financial boosts.

Since leaving public office, Long has gained experience as a business and tax advisor, helping SMEs navigate the often complicated landscape of IRS rules and regulations—a skill set that Trump claims will resonate well with taxpayers and IRS employees alike. This assertion raises questions regarding the balance between tax advocacy and enforcement that Long may have to negotiate, especially if he wishes to champion both taxpayer interests and IRS objectives.

A point of contention in this nomination is Long’s track record. Serving six terms in the House of Representatives allowed him to build relationships that may prove advantageous in navigating Congress, yet his engagement after leaving office has attracted scrutiny. Senate Finance Committee Chair Ron Wyden has voiced apprehensions regarding Long’s involvement with the controversial Employee Retention Tax Credit (ERTC), a measure aimed at assisting businesses during the COVID-19 pandemic. Critics argue that the ERTC has become a vector for widespread abuse, with many businesses submitting dubious claims that the IRS has had to investigate thoroughly. The very optics of this association may present credibility challenges for Long as he embarks on this new leadership path.

Moreover, opinions vary even among former IRS officials regarding Long’s suitability for this pivotal role. While some assert that his congressional experience offers a positive and credible perspective to the agency, others suggest he stands as an unconventional choice when compared to previous IRS leaders who boasted extensive professional backgrounds in tax administration or law.

The IRS has faced a range of issues in recent years, ranging from inefficiencies in processing taxpayer information to concerns about privacy and the agency’s heavy focus on enforcement. Critics of the current administration’s approach believe that the IRS should gain more independence from political interference, something that Long may be positioned to address effectively, leveraging his congressional experience to argue persuasively for the agency’s needs.

Republican Senator Mike Crapo voiced support for Long, citing the pressing challenges the IRS has faced and emphasizing tax protection as a top priority. However, with a stark ideological divide currently characterizing Congress, Long’s ability to unify differing factions around a coherent vision for the IRS might be tested.

Long’s tenure, if confirmed, could set the stage for a new direction for the IRS, touching on everything from enforcement priorities to how the agency interacts with taxpayers. The evolution of the IRS operates within a complex interplay of political forces, public sentiment, and administrative challenges that won’t be resolved quickly or easily.

Billy Long’s potential leadership of the IRS may bring about significant changes, but it is fraught with challenges that could undermine or enhance his effectiveness. Ultimately, the success of this appointment will depend on Long’s ability to navigate the intricacies of tax policy, agency reform, and the overarching political climate. The stakes are high as America stands on the brink of what could be a transformative, yet contentious, chapter in IRS history.