The Biden administration’s recent withdrawal of two significant student loan forgiveness proposals marks a pivotal turn in the landscape of federal education debt relief. This decision leaves millions of borrowers grappling with uncertainty and reflects the ongoing complexities of student loan policy in America. In this article, we will delve into the reasons behind this move, analyze the broader implications for borrowers, and examine the current available options for those still seeking relief from their educational debts.

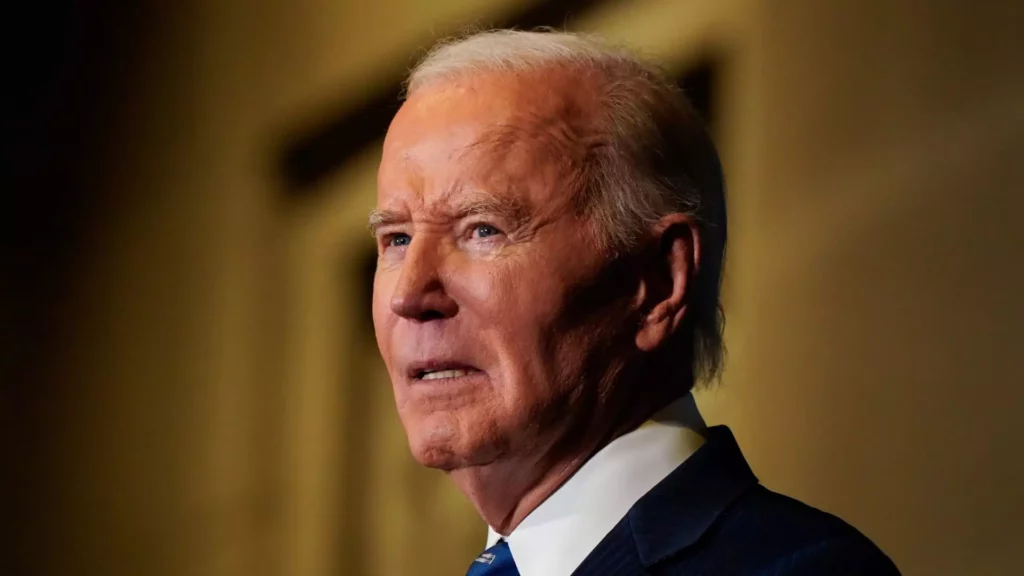

Initially, the Biden administration proposed regulations designed to empower the Secretary of Education to forgive student loan debts for various groups, including long-term borrowers and those facing financial challenges. These measures, if enacted, could have dramatically altered the financial conditions of millions of Americans tied down by educational debt. However, on a recent Friday, the Department of Education formally announced its decision to rescind these plans, citing operational difficulties in implementation and a shifting political climate as primary reasons.

This withdrawal occurred just weeks before Donald Trump’s anticipated inauguration. Trump’s administration has been openly critical of student loan forgiveness initiatives, labeling them as ineffective and legally questionable. Observers noted that the Biden administration recognized the high likelihood of these forgiveness proposals facing significant hurdles under Trump’s presidency. Mark Kantrowitz, a noted higher education expert, emphasized that it was strategically sound for Biden to withdraw the proposals to avoid further political confrontation.

The cancellation of these plans has led to dismay among advocates for student debt relief. Organizations like the Student Borrower Protection Center highlighted the detrimental impact of this decision on the economic mobility of millions. Persis Yu of the center conveyed that the retraction represents a missed opportunity to alleviate the overwhelming burdens of student debt on American families, potentially stifling not only individual livelihoods but also wider economic growth.

This undercurrent of disappointment is expressed by voices in the personal finance community, who emphasize the gravity of the student debt crisis. Elaine Rubin from Edvisors stated that concerns loom large regarding how borrowers will navigate their futures in light of new administration policies. With such crucial proposals stalled, many are left questioning how they will handle their obligations and what tomorrow holds.

Despite the absence of the ambitious forgiveness plans, other avenues for financial relief remain viable. The Department of Education continues to endorse existing programs such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). Under PSLF, borrowers engaged in public service can have their student loans discharged after ten years of qualifying payments. On the other hand, TLF enables educators working in low-income schools for five consecutive years to receive substantial loan forgiveness.

In a recent announcement, the Biden administration indicated it would forgive an additional $4.28 billion in student loan debt under PSLF for nearly 55,000 borrowers who meet the program criteria. Such initiatives offer glimmers of hope amid the overarching disappointment stemming from the withdrawal of broader proposals. Still, concerns persist about the future viability of these programs, especially with potential changes in the political landscape.

As borrowers navigate this complex environment, awareness of available resources is crucial. Websites like Studentaid.gov provide borrowers with tools to find federal relief options that continue to exist. Furthermore, institutions such as the Institute of Student Loan Advisors maintain comprehensive databases detailing state-specific loan forgiveness programs.

Ultimately, the Biden administration’s decision to retract major student loan forgiveness plans reflects a broader struggle with the intricacies of educational financing in America. As the nation anticipates a new political season, the future of student loan forgiveness remains uncertain. Advocates for borrowers urge ongoing vigilance and perseverance, recognizing the continued importance of securing equitable pathways to education and financial stability for millions of Americans confronting the burden of student debt.