Super Micro Computer, a company specializing in server technology, has recently experienced drastic financial turbulence and a significant drop in its stock value. The firm has faced mounting scrutiny, not just from investors but from regulatory bodies as well. This article will break down the recent events leading to the company’s stock plummeting, the responses from management, and the implications for its future.

On a rather turbulent Wednesday, Super Micro’s shares fell by an alarming 22%, reaching their lowest value since May of the previous year. The stock price nosedived to $21.55 in early afternoon trading, marking an eye-watering 82% decline from its March peak of $118.81. This plunge has erased approximately $57 billion from the company’s market capitalization, sending shockwaves through the investor community and raising questions about the company’s financial health and governance.

This critical dip is largely attributed to Super Micro’s release of disappointing unaudited financials, compounded by a lack of clarity regarding its plans to maintain its listing on the Nasdaq. The company’s recent audits have sparked concerns, particularly following the resignation of its auditor, Ernst & Young—a decision that adds to the drama as it marks the second auditing firm to resign in less than two years. Analysts and investors have voiced their unease, grappling with the implications of these developments.

Adding further complexity to the situation, Super Micro is currently embroiled in issues surrounding accounting irregularities. An activist investor has raised concerns alleging that the company has engaged in questionable accounting practices and even sent sensitive technology to nations and companies under sanctions. These accusations are serious and have raised alarms not just within the company but across the regulatory landscape.

Super Micro has not filed its audited financial results since May, putting it at risk of being delisted from Nasdaq should it fail to submit the necessary results to the Securities and Exchange Commission (SEC) by mid-November. The lack of transparency in financial reporting not only affects investor confidence but also puts the company under the scrutiny of regulatory bodies that may impose further restrictions or penalties.

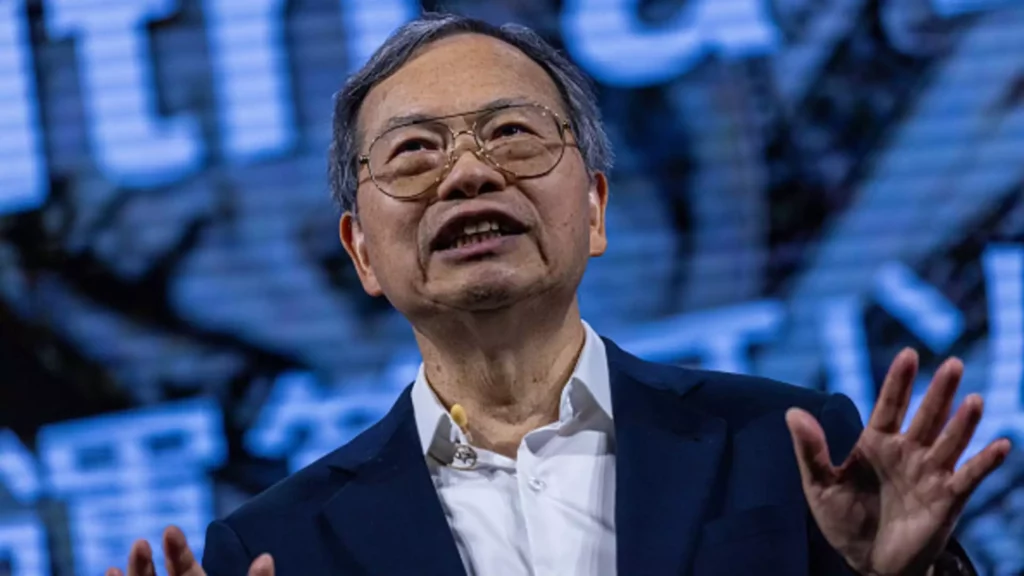

During a recent call with analysts, CEO Charles Liang and other executives sought to provide reassurance amidst the chaos. Liang emphasized that the company is prioritizing the hiring of a new auditor and is working urgently to resolve its reporting issues. However, when pressed on Ernst & Young’s resignation and ongoing governance issues, Super Micro’s management appeared evasive, choosing not to delve into specifics.

The preliminary financial results for the first fiscal quarter indicated net sales between $5.9 billion and $6 billion. While this represents a 181% increase year-over-year, it fell short of analyst expectations of $6.45 billion. The company’s substantial growth in recent months has largely been driven by robust demand for servers integrated with Nvidia processors tailored for artificial intelligence applications—a sector that has seen exponential growth.

Despite impressive sales figures, the projections for the upcoming quarterly performance were also underwhelming. Super Micro estimates revenue ranging from $5.5 billion to $6.1 billion, significantly below the $6.86 billion projected by analysts. Such forecasts contribute to the uncertainty surrounding the company’s trajectory.

Amidst troubling financial forecasts and considerable investor anxiety, there remains a glimmer of hope for Super Micro, primarily rooted in its close partnership with Nvidia. Liang reiterated the strength of this relationship while discussing the latest Nvidia GPU, known as Blackwell, asserting that they are actively working to enhance production with Nvidia. While the two companies have confirmed continued collaboration, analysts remain skeptical, questioning whether Super Micro will have sufficient access to new chips in a market that is evidently tightening in capacity allocation.

Consequently, industry analysts have paused their coverage of Super Micro, citing the lack of comprehensive, audited financial statements as a primary concern. This caution reflects broader apprehensions about the company’s stability and future performance. The market is left with more questions than answers as they await further clarifications on the company’s financial integrity and operational strategies.

Super Micro finds itself at a crossroads, facing unprecedented challenges related to governance, regulatory scrutiny, and market expectations. While there are some promising indicators, particularly in their relationships with leading tech companies like Nvidia, the path to recovery appears fraught with difficulty. The upcoming months will be pivotal as investors, analysts, and management alike await clearer strategies and actionable plans in response to the mounting pressures. Only time will tell if Super Micro can truly weather this storm and reclaim its former status in the tech industry.